Everything has risks. Cash is fraught with risks - inflation and currency fall.

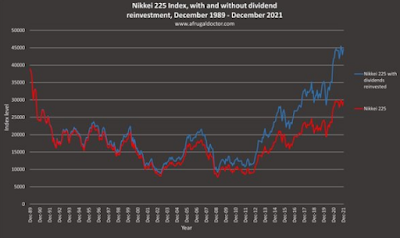

It basically depends on your budget and what you invest in. Extensive indexes are always returned. The Nasdaq fell 76% after 2000, but bounced back, with the German DEX recovering from a similar decline. Even the Japanese Nikkei returned if profits were reinvested.

|

In comparison, many individual stocks have gone to zero or never returned.

➤Globally diversified stock indices, such as MSCI World, and not just individual countries. US markets are also global markets because these firms are global.

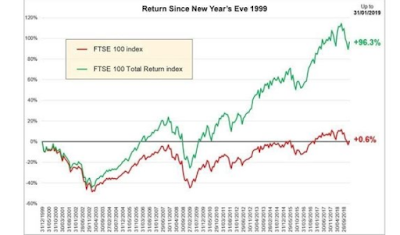

➤Reinvesting profits and not just relying on capital growth

➤Invest during different time periods. Hence, lump sum and monthly injections. So, you don't have to worry about whether 'now is the best time to invest'.

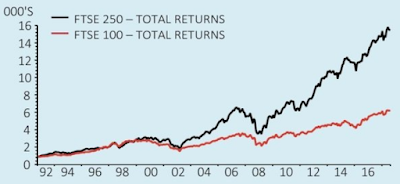

➤Hold small, medium, and large-cap stocks. Look at the UK market since 2000. The FTSE has performed poorly in terms of capital growth but is fine if dividends are reinvested.

|

| What is the main risk of investing? |

0 Comments