First, some immigrants use their native Canadian addresses to open accounts abroad.

step 1 This is dangerous because it is misusing your Canadian proof of address document to open an account. Most Canadian brokers will close non-resident accounts if they find out.

step 2 I've had countless people reach out to me who have been in this situation, especially if they went to a place like Russia, which is banned.

step 3 Being forced to sell and liquidate is also a potential tax event, so it's best avoided.

step 4 So what you need is a portable solution - apply now for a portable, expat-focused, investment plan!

step 5 In other words, if you leave Canada or your new country of residence, the account will not simply close.how to trade in the international stock market

step 6 There are two options for portable, expat-friendly accounts. They are do-it-yourself (DIY) and consultant-led.

step 7 DIY will be a little cheaper, but will take longer. What's more important, however, is that statistics show that the majority fail long-term.

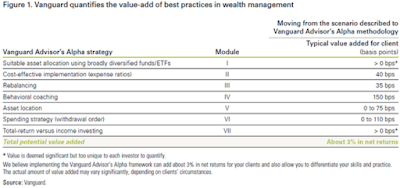

step 8 Research by Vanguard, and others, has found that DIY investors tend to underperform, at least over the long term.

Apart from the above chart, the main reason is the failure to control emotions.

step 9 We see these days. Markets fluctuate as a result of the Ukraine-Russia situation, inflation, interest rates, and many other events.

step 10 Not just volatile but unpredictable. It always happens, but these moments increase every few years.

step 11 Social media has made it more difficult for people to be prudent, as many people see fear-mongering content and then delay investing.

step 12 A good advisor can make emotional self-control easier, just like getting fit, if you get a personal trainer and diversify your assets properly.

step 13 In any case, with both options, you need to provide your ID and address proof + fill out an application form to get started.

0 Comments