Short Answer - For a beginner who is just starting out his/her investment journey, Mutual Fund is the best way to invest in the stock market. While seasoned investors who are capable of evaluating a company, its financials, and its management might find a better value by investing directly in individual stocks and shares.

Long Answer - For most working professionals, it is impossible to study and analyze a stock. After that, make a list of stocks to invest in. Then track those stocks for days, if not weeks, to pick the right time to jump in. It is nearly impossible.

|

| How do beginners invest in the stock market? |

Stock Picking is a full-time job and the position is called ‘Portfolio Managers / Fund Managers”.

So for most retail investors, Mutual Fund provides the safest way to invest in the stock market.

A fund manager, who is an expert in this field, manages your investment for a very small fee called Expense Ratio. It generally ranges from 0.5% to 1%. In some rare cases, where the fund has been performing exceptionally well over multiple years, it might have an Expense Ratio of over 1%.

For most retail investors, a mix of a Large Cap Fund and a Midcap Fund (or a Smallcap Fund, if you are feeling lucky) is ideal. If you have crossed the 50 Years Old mark, then you might introduce debt into your mix of funds.

It doesn’t mean retail investors cannot get their hands on those DEEPAK NITRITEs and the APOLLO TUBEs of the stock market (basically, talking about multi-bagger stocks).

As a retail investor, a simple strategy you can deploy is - Keep investing in your portfolio of Mutual Fund/s, and side-by-side, keep your eye over smallcap or midcap individual stocks.

You don’t have to invest in those stocks. Just follow and track them.

See, how their price moves, how they react to quarterly results or any kind of news, and follow how their financials and books change over time. Just watch them!

After a year or so, you will notice that your “intuition” of spotting multi-bagger stocks has improved.

After a few years, you too will be able to pick and spot those future DIAMONDS like SRF, Kama Holdings, Chola Investment, etc.

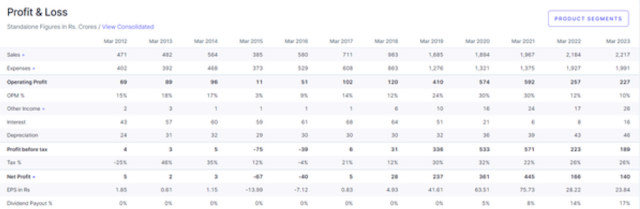

And if you are a seasoned investor and you can spot what’s wrong with the PnL Statement below, then sure, start investing in individual stocks.

Comment below what you think is wrong with the PnL Statement of this company. I will upvote the correct comment.

Meanwhile, you can follow, study and read about multi-bagger stock on Money Premier. Just Google - money premier dot net and search for “multi-bagger “ within the website.

What are popular strategies for making money in the stock market?

There are a number of well-liked stock market profit-making techniques. Here are a few illustrations:

1. Long-term investing: buying and holding shares for a long period of time, usually years, in the hope that they will increase in value.

2. Value investing: Finding undervalued stocks using fundamental analysis and making investments in them in the hope that the market will eventually realize their true worth.

3. Focusing on stocks of businesses with strong growth prospects, frequently in new or inventive areas.

4. Day trading is the practice of buying and selling stocks during a single trading day in order to profit from swift price changes.

5. Investing in equities that regularly pay dividends enables investors to generate money from their holdings.

6. Profiting from short-term price fluctuations by riding the momentum of stocks with upward or downward price trends is known as momentum trading.

.jpeg)

0 Comments